THE #1 ADDITIONAL INCOME SOLUTION FOR TAX ERO'S

What over 8311 Tax ERO's claim to be the hottest New Way to Increase Your Revenue In the 2023/2024 Tax Season! Learn About Tax Software Service Bureau!

What over 8311 Tax ERO's claim to be the hottest New Way to Increase Your Revenue In the 2023/2024 Tax Season! A Tax Software Service Bureau

Would you like to earn an extra $2,000, $4,000, $8,000, or even $30,000 in revenue for the 2023/2024 Tax Season without DOING A SINGLE ADDITIONAL TAX RETURN?

Would you like to get paid an extra $2,000, $4,000, $8,000, or even $30,000 in revenue for the 2023/2024 Tax Season without DOING A SINGLE ADDITIONAL TAX RETURN?

Scroll Down

Learn The Money Making Secret They Don't Want You To Know...

Who Is This For..

Do you do more than 50 Bank Products returns per tax season?

Do you do more than 200 Bank Product return across all your offices combined?

Do you own and operate multiple Tax Offices?

Are you paying ridiculous fees for tax software each tax season?

Do you have your own EFIN but still splitting fees?

Do you think about being your own boss and want to get out from working under someone else?

If you have watched the training above, any of the above conditions pertains to you, then this is for you! Click the link below to choose a package that best fits your needs.

PROCESS

The Simple 3 Step Process To Get Started

STEP 1

Purchase your Package

To get started decide on which package is best for you and go ahead and purchase it.

STEP 2

Submit Current Fees

Go to the back office of your current software and submit your current fees so we can evaluate.

STEP 3

Get Set Up

Submit your enrollment form and lets get you set up in your new software.

4.9/5 star reviews

4.9/5 star reviews

Earn Additional Income With Service Bureau Fee Rebate!

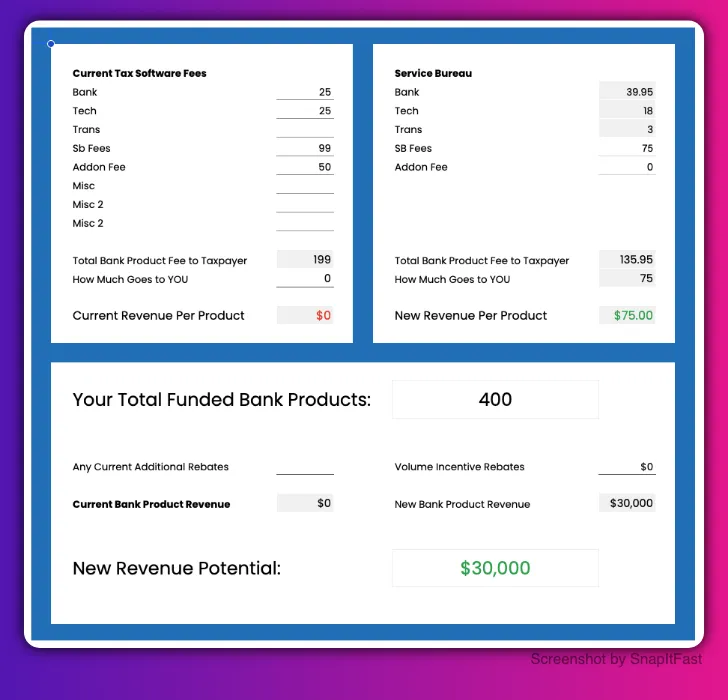

How much money could you be missing out on?

Earn Additional Income As a Tax Software Service Bureau!

Amazing thing you get lorem ipsum

Great bonus you get lorem ipsum

Amazing thing you get lorem ipsum

"Best purchase ever!"

"I could believe how much money I was leaving on the table."

Our Partners...

What You Get...

Set your own Service Bureau Fees or Get a 50% Rebate on Every Bank Product

Get your own Branded Tax Prep Software

Manage Multiple Tax Offices

Mobile App for your clients to Start their Tax Return

Complete software setup and in Season Support...and more...

STILL NOT SURE?

14 Day 100% Satisfaction guarantee

You wouldn't buy a car or a house without first entering and checking it out or test drive it, so we're big believers in giving you the same chance with our software as well.

The moment you enroll, you get access to the tools that helps you actually make money with our software.

STILL GOT QUESTIONS?

Frequently Asked Questions

Do I have to jump through hoops to get my money back if I apply within 14 day?

No! Absolutely not. If you request it within 14 day, you will get your money back no questions asked.

Is this software a lesser version than the ones we directly from the software companies?

Absolutely not. All our software are just branded version of the original software from the software companies. The reason you would want to buy from us instead of directly from Tax Slayer, or OLT Pro, or Crosslink is because of all the added bonuses and support you get from working with us vs them. Try calling them during tax season with a question a see!

What if I get stuck or need help with something?

We totally understand that tech can be an issue sometimes, so we wouldn't expect you to manage everything yourself.Our support team is here to help whenever you need help with something. For further questions, email us at [email protected]

Get Your Package Now!

You're not making a full commitment right now because you have 14 days money back guarantee. Test drive it and then make a decision. We ask you to pay first to ensure you're serious about increasing your income.

100% Satisfaction Guarantee!

Copyrights @ 2023 | TaxMatePro™ All rights reserved| Terms & Conditions